Wealth Management

That Makes a Difference

With full support to help you keep more of what you make.

Whether you’re planning for your family’s future, running a business, nearing or in retirement, ProActive Advisors can develop a road map for your success. Get it right the first time. Rely on ProActive Advisors as your trusted financial partner.

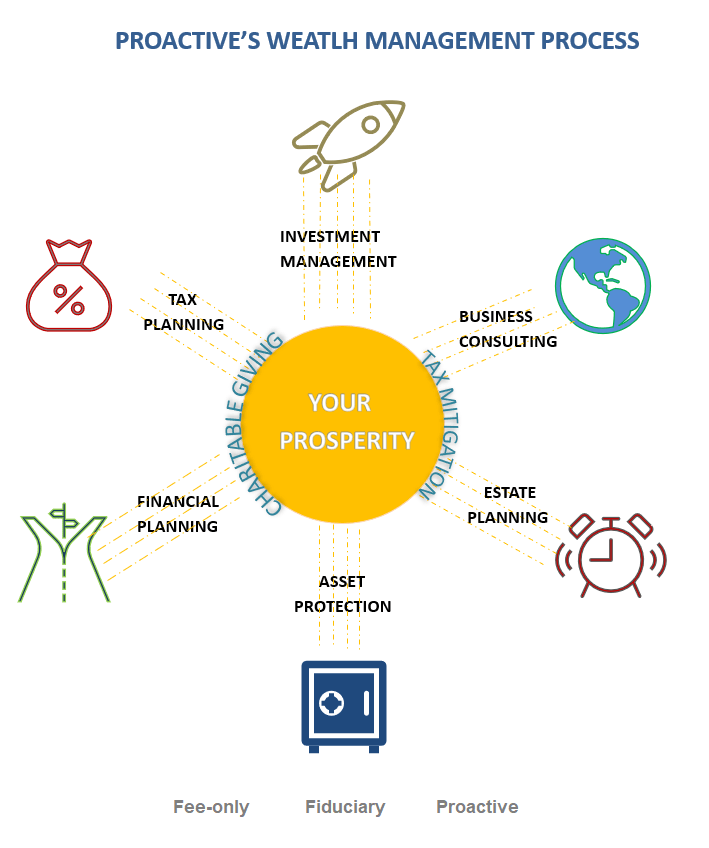

Building wealth and keeping it requires a well-honed process that delves into relevant financial, legal, tax and investment details. Insights gleaned from this discovery process form the foundational pillars of your personalized investment strategy to grow your net worth.

A Premier Five Star Advisor dedicated to guiding individuals, families, small business owners, and private trusts.

Fee Only • Fiduciary • ProActive

What Clients Say about Us...

“I always read you guys newsletters on the state of the economy/political climate/your position on investing. I find them very interesting and informative.”

Greg S.

“Market conditions like these is what made your services in particular attractive to me.”

Tim C.

“When we first chose Lawrence’s Advisory firm, we gave money to 3 Advisors to invest. After a year, we saw a convincing difference.”

Anita T.

Our Wealth Management approach is designed to exceed your expectations and improve your bottom line.

Generational wealth is about keeping money safe for generations and that requires protecting it from relentless threats: volatile markets, inflation, shifting tax laws, creditor risks, and the challenge of passing wealth to beneficiaries. Let ProActive Advisors enhance your financial security by tailoring a strategic plan to protect your assets. Commensurate with the process, we’ll also provide access to our curated team of tax & legal specialists to devise a stalwart defense ensuring your strategy is optimized and tax efficient.

Your business interests aren’t just numbers—they’re your life’s work, your family’s financial future and your legacy. Because most accountants are tax preparers focused on timelines, you may be paying unnecessary tax bills. Part of ProActive Advisor’s Advisory services is to provide cost beneficial Tax Planning services to identify potential opportunities for tax savings and effectively communicate those findings to minimize your tax liability. This includes access to our Virtual Family Office (VFO) of specialized professions with us quarterbacking the workflow to ensure your priorities are met. That’s the value-added benefit that makes our fee for services cost-effective for you.

ProActive Advisors’ “GPS System” for financial plans lays out the action steps for managing family finances to meet important financial goals and grow your net worth to a necessary amount by a future date while monitoring process to keep Score (Goal, Plan, Score).

Financial Planning and disciplined Investment Management are integrated - planning requires implementation. Our adapted Total Return methodology is formulated to target above-average, risk-adjusted returns harnessing the power of compounding interest, dividends, and capital gains to grow net worth. This isn’t passive investing. Its proactive investing seeking growth while managing market risks. Below are financial goals often combined:

Building Net Worth

Think of your net worth as a “Report Card” for your family’s financial well-being. Let our financial professionals guide you in managing the drivers to make the most of it. Along the way, the goal is to make sound financial decisions to have more than you saved.

Retirement Planning

Pursuing retirement requires ensuring future income and lifestyle goals are realized. Yet planning and good outcomes come down to implementation & sound management. That’s how we help. We are proactive in managing risks so you have greater peace of mind.

Wealth Management

Wealth is built by managing your cash flow, lowering the taxes you pay, and carefully investing to capture favorable reward-for-risk opportunities. Get ahead, guided by our fiduciary advisors who’ll create a plan tailored to helping you create your desired lifestyle.

Financial Advice

Sound financial decisions must consider present risks & opportunities in the context of your personal circumstances. Included with our investment management is on-going financial counsel to guide all your financial decisions.

Tax Planning

Today’s national debt almost guarantees higher tax rates. Let ProActive help you keep more of what you make and save by developing personalized tax strategies synced with your finances to improve your financial life.

Charitable Giving

Giving back by supporting causes that align with your values and goals while you’re still living can offer income and tax advantages as well as fulfillment. Find out how to help others while benefiting yourself at the same time.

Financial Planning

Determining relevant factors and appropriate strategies to maximize strengths and minimize weaknesses are the cornerstones of successful financial planning. Let our skilled fiduciary advisors design a well-planned roadmap to improve your financial health.

401K/403b/457 Management

Saving early and regularly for Retirement gives you time to compound your savings but investing wisely with risk management is also crucial. Let us assist you in keeping your costs low to improve results, particularly if you need to kickstart or boost your retirement savings.

Special Needs Planning

Let ProActive Advisors assist you in ensuring that your loved ones with behavioral, mental, and/or physical challenges are able to live their best lives. Accomplish this with our special needs planning designed to attend to their future financial needs.

Nothing is certain but death and taxes. How much you pay can usually be lowered with Tax Planning. Indeed the US tax code now exceeds 73,000 pages, many with deductions, credits, exceptions and loopholes. If you’re a business owner or high net worth individual, you may be overpaying taxes by thousands of dollars. At ProActive Advisors, we evaluate your circumstances and examine your tax returns to identify potential tax saving opportunities. Then we consult with your CPA or one of our third-party, tax specialists to confirm which opportunities are appropriate. We provide our services at no cost to you and you only pay the tax specialists if they provide work product, amend or prepare and file tax returns.

Estate Planning gives peace of mind, protection for your loved ones, and preserves your legacy exactly as you envision it. Yet the legal aspects are daunting replete with legalese.

Let ProActive Advisors quarterback the entire legal process aligning it with your financial goals to ensure your priorities and wishes are legally addressed. We’ll even introduce you to a top estate planning attorney who’ll draft your wills, trusts, healthcare directives, and powers of attorney. We’ll intermediate every step of the way streamlining the planning and implementation so the end result is a smart, personalized legacy plan with clarity for those who matter most.

True Wealth Management isn’t just about investments - it’s the seamless integration and optimization of financial planning, tax planning, wealth management and estate planning with implementation to achieve important financial goals. Our "Virtual Family Office“ model offers a more affordable alternative to the ultra-rich family office approach to address complex legal and tax matters. Implementation, portfolio monitoring and corrective action to combat market risk are done for you. Our goal is comprehensive financial planning with sound financial management to optimize real returns after tax.

ProActive Advisors, LLC is a Registered Investment Advisor providing wealth advisory services which primarily consist of financial & tax planning and investment management services. We do not provide accounting, tax, or legal services, although we collaborate with other professional advisors for better after-tax outcomes. For more complete details about our advisory services and fees, please see our Fee for Services page.

ProActive Advisors, LLC

836 Euclid Ave, Suite 306

Lexington, KY 40502

859-263-1117

© 2026 ProActive Advisors, LLC