Fee-only • Fiduciary • Proactive

Building wealth and keeping it requires commitment beyond passive investing because risks are always present. If you think your family could benefit from working with a team focused on your bottom-line with loyalty solely to you, let’s talk and we’ll tell you more.

Our Process

At ProActive Advisors, we understand clients have different needs and circumstances and want to invest carefully and wisely. That’s why our Wealth Management process is designed to synchronize planning, implementation, management and distribution in a tax efficient way.

With Advisory services from Financial Planning to Asset Protection, from Account Implementation to Investment Monitoring, and from Long-Term Care to Estate Planning, we work to secure your family’s financial security. It’s a partnership built with a step-by-step process to give you peace of mind.

After understanding your situation and need for Growth, Income, Liquidity, Tax Advantages and Safety, we identify the obstacles and the opportunities.

A recommended plan of action is then devised to improve your Reward-for-Risk potential. Your wealth management strategy is then implemented.

After-tax performance is monitored and corrective action taken when financial trajectories require adjustments.

Our Wealth Management process is designed to integrate your personal, business, wealth, legal, and tax matters to improve their financial efficiency.

- Are you simply filing your taxes or working to lower the taxes you owe?

- Would reducing income and capital gains improve your bottom line?

- Need tax smart financial guidance that positions you and your family for greater financial security?

Gaining financial security is a step-by-step process along a pathway tailored to your near- and long-term goals. With the inevitability of higher taxes at the end of 2025, it's never been more important to ensure the alignment of your overall financial strategy with your tax circumstance to maximize efficiency. Avoid sales pitches in disguise and visit with our fiduciary advisors who always work to serve your best interests. Discover the difference. Meetings are about how we can help and are at no cost to you.

Who's Watching Your Money?

The answer may very well be no one!

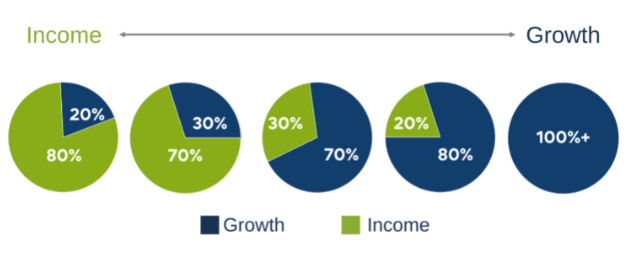

Traditionally, investment firms match client profiles to one of the above fixed allocations and regularly rebalance accounts back to it seeking to hold market risk exposure constant. Today, computers do that automatically. This pseudo account management practice can lower long-term performance because it ignores valuations, price paid and business cycle changes.

At ProActive Advisors, we see the financial markets as dynamic and driven by political and economic events such as changes in interest rates, tax and trade policies, etc. Our focus on compounding and our use of a proactive asset allocation strategy aims for consistent long-term returns instead of below-average returns with the market risk associated with a fixed allocation strategy.

(Hint: after investment costs are deducted, index fund returns are below the market averages!)

Personalized Financial Advice

Designed to Enhance Your Quality of Life.

Cost vs. Benefits

There are quantifiable benefits to a formal financial plan & engaging a trusted advisor. These benefits have been studied by Michael Kitces (2015) and Morningstar Associates (2019) and Vanguard (2022).

The formal financial plan benefits fall into one of the following categories.

- Financial Gain

- Tax Savings

- Risk Reduction

- Guidance and Support

- Peace of Mind

The first three are ‘hard money’ benefits that are more easily quantified. The last two are ‘well-being’ or intangible benefits that lessen stress and improve quality of life. Do you have the education, time, expertise, and inclination to stay abreast of IRS rules, legislative changes, and the economic factors driving the financial markets to maximize what you keep? This is where having a financial partner acting as your personal CFO can benefit you. Outcomes will vary by financial advice, implementation, your circumstances, and are not guaranteed.

Define Goals • Make a Plan • Keep Score

ProActive Advisors, LLC

836 Euclid Ave, Suite 306

Lexington, KY 40502

859-263-1117

© 2025 ProActive Advisors, LLC