We build flexible, goal specific Wealth plans and manage your financial risks.

Our Process

Generic financial plans with auto-pilot management don't address the complexity of Wealth Management. ProActive Advisors builds customized wealth plans with strategies that align your investments, taxes, and financial goals so they work smarter while you live with greater peace of mind.

After assessing your need for Growth, Income, Liquidity, Safety and Tax Advantages, we identify the challenges and opportunities.

Real, after-tax performance is monitored and corrective adjustments made when financial trajectories get off track.

Real, after-tax performance is monitored and corrective action taken when financial trajectories require adjustment.

- Are you working to lower the taxes you owe or simply filing your taxes on time?

- Would your focus on inflation-adjusted returns give you more spending power?

- Could smart financial guidance with smart tax strategies benefit your bottom line?

Investment strategy must be vigilant of unknowns and proactively manage risks. We invite you to compare our approach and have a conversation to find out more. Exploratory meetings are always complimentary.

Who's Watching Your Money?

The answer may very well be no one!

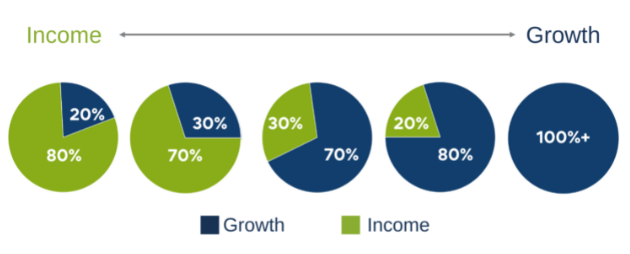

Conventional investment firms typically match client profiles to one of the above fixed asset allocations and regularly rebalance back to it seeking to keep risk-exposure constant. This practice ignores interest rates, valuations, taxes, business cycles and the reality that markets are dynamic not fixed.

The fact is that markets are driven by economic and political events. Merely rebalancing a diversified portfolio provides inadequate risk management and can lead to subpar performance.

We believe that no one can consistently predict or time the markets.

We’ve built our 360Portfolios investment strategy on 3 axioms of finance:

- Statistical precedence

- Observable facts

- The principal of compounding

We’re excited to share more about how you can take advantage of smarter strategies and limit risks. Meetings to learn more are complimentary. To make an appointment, click the "Let's Talk!" icon at the lower left corner of this page or text message us at 859-263-1117.

Personalized Financial Guidance

Designed to Enhance Your Quality of Life.

Cost vs. Benefits

There are quantifiable benefits to a formal financial plan & engaging a trusted advisor. These benefits have been studied by Michael Kitces (2015) and Morningstar Associates (2019) and Vanguard (2022).

Formal financial plan benefits fall into the following categories:

- Financial Gain

- Tax Savings

- Risk Reduction

- Guidance and Support

- Peace of Mind

The first three are ‘hard money’ benefits that are more easily quantified. The last two are ‘well-being’ or intangible benefits that lessen stress and improve quality of life. Ask yourself - Do you have the education, time, expertise, and inclination to stay abreast of IRS rules, legislative changes, and the economic factors driving the financial markets to maximize what you keep? This is the benefit of engaging a financial partner to act as your personal CFO. Of course, results will vary by client circumstance, risk capacity and investment management success, which cannot be guaranteed.

Define Goals • Make a Plan • Keep Score

ProActive Advisors, LLC

836 Euclid Ave, Suite 306

Lexington, KY 40502

859-263-1117

© 2026 ProActive Advisors, LLC